Hidden factors that make receiving payments unnecessarily expensive

Sticking to inflexible invoice and payment solutions devours internal resources, slows your growth journey – and allows your competitors to overtake you. Here are the underestimated factors that increase your total costs, both in the short and long terms.

How much does your company actually pay to receive payment?

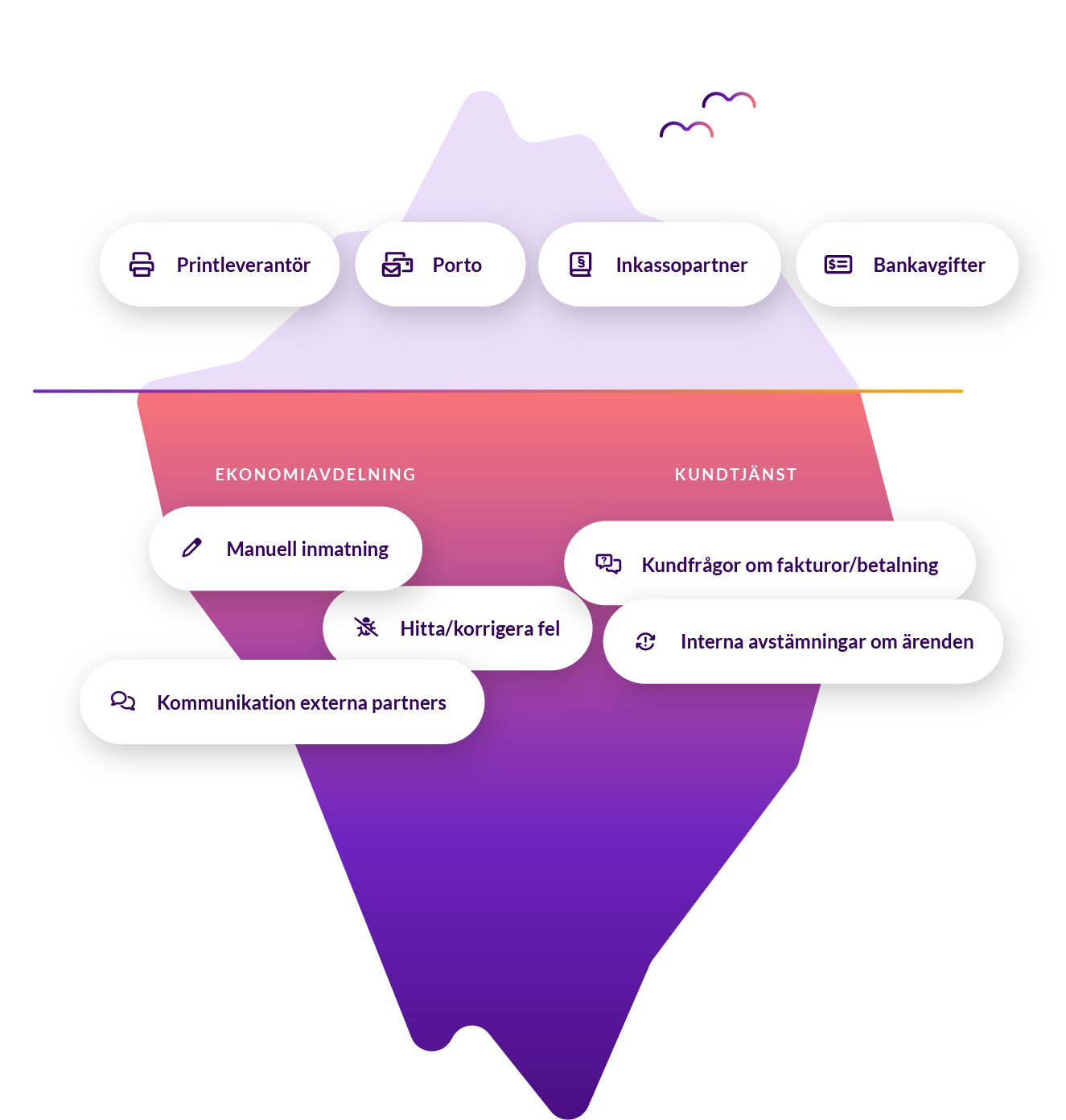

When assessing the costs of invoicing and payment, you probably consider external factors, such as:

- Distribution partner

- Postage costs

- Bank fees

- Debt collection partner

But these are only the tip of the iceberg; the total cost is significantly greater. Many underestimate the indirect costs of internal administration and other time-consuming processes, such as:

- Manual data entry in the invoice and payment process

- Continuously maintaining separate solutions with distribution partners, banks, and debt collection partners

- Managing erroneous payments

- Answering questions from customers about invoice and payment

- Internal reconciliations in various customer cases

- Global monitoring of changing regulations and making adjustments to ensure compliance

- Global monitoring and implementation based on changes in the market (e.g. adding new payment methods)

4 factors that make your invoicing more expensive – short and long terms

The indirect costs above devour resources and also steal time and energy from your core business. But there are also other invoice and payment-related factors with major financial effects. Which of these do you recognize from your own business?

1. Under-prioritization of maintenance = ticking cost bomb

Since invoicing and payment are not seen as a focus area in their own right, system maintenance, updates and investments tend to be under-prioritized. This creates a vulnerability that can be described as a ticking bomb. Eventually, the situation risks becoming so critical that a small error in any of your systems can stop the entire billing process.

2. Wrong incentive = increased costs – and risk of churn

Regardless of whose fault it is that a payment has been delayed, every additional fee tends to annoy the customer. This in turn leads to more cases with your customer service department – and increased costs for you. Data from a number of companies in industries such as energy, telecom and insurance also show clear connections between reminder debt collection cases and customer churn.

These insights are important to consider when deciding how your company handles late payments, as well as when considering external billing and payment partners. Think about the incentives and drivers in different companies and whether they align with your goals. For example, does a debt collection company benefit from your customers being satisfied and staying loyal for a long time? Or do they earn more from the more late payments they can collect? The revenue your company receives through “hard” methods needs to be set against the costs of a negative customer experience – or a lost customer.

Tip! Be inspired by how mobile operator Hallon creates business value and loyalty through customer-friendly debt management.

3. Lack of scalability = puts the brakes on your growth

Is your company planning to grow, perhaps even internationally? This places high demands on a flexible and scalable billing solution – something that too few companies have today. Instead, it is common to invest in custom-built solutions that suit the needs of the moment, but are not future-proof.

This puts a spoke in the wheel the day you want to scale up. For each new country, you will need to spend time and resources researching the legislation, negotiating with local suppliers and building a process of your own. And this is expensive. But from a bigger perspective: what does it cost in lost revenue if your company gets up and running too late in a new market and is overtaken by a more fast-paced competitor?

Tip: Read the article on how a PSP-licensed payment partner can support your company’s international growth.

4. Complex supplier structure = missed opportunities for valuable synergies

An invoice and payment process that relies on a variety of external partners and/or complicated self-built solutions leads to increased administrative costs in the short term. But it is just as important to consider the consequences of everything you cannot do.

The more complex your supplier structure, the more difficult it will be to obtain an overview of both internal processes and the customer experience. With your current setup, what opportunities do you have to follow customer behaviors at different stages of the life cycle? See the connection between payment methods and the amount of customer service tickets? Draw conclusions from multiple data sources and exploit potential synergies?

There’s a smarter way to work

Even if you think your invoice and payment processes are working here and now, there are guaranteed to be things you can do to optimize, streamline, and future-proof – and gain advantages over your competitors. However, settling for “good enough” risks being very expensive in the long run.

Instead, you need to stop working in silos and adopt a holistic approach to the invoice and payment process. In order to succeed, you also need to stop comparing apples and oranges when evaluating your options. Read how in our article about the benefits of an end-to-end solution.